Data-Driven Battery Health Assessment: The Key To Maximizing EV Residual Value

We’ve all heard the good news. Deloitte projects the global EV market to achieve a compound annual growth rate of 29% over the next ten years. The Biden administration has made electric vehicles a centerpiece of its climate strategy. For OEMs with a stake in the electric vehicle market, news like this is highly encouraging.

While exciting, this transition to electrified transport comes with complexities. For example, there is the prospect of the entire financial model of the legacy auto industry being turned on its head. One of the key unanswered questions? Resale value, or what insiders call residual value – how to assess it, and how to convert measurements into strategic financial decisions. Post-lease resales are a critical part of the business model for the captive finance arms of most auto OEMs – and when it comes to EVs, there are still a lot of unknowns.

Currently, these unanswered questions about battery health are sapping confidence and depressing EV resale values. But it doesn’t have to be this way. The proper monitoring and in-depth, data-driven analysis of EV battery health can provide the information and confidence that OEMs need.

The Challenge of Quantifying EV Residual Value

At Voltaiq, we have many conversations with auto OEM customers. And they all tell us the same thing: lease financing is a major profit driver. Auto OEMs take a new vehicle, lease it out for a set number of years, and then when the lease is up, they sell the vehicle on the resale market. Scaled up to many thousands of vehicles, this is a core source of revenue.

This time-tested business model depends heavily on accurately predicting the residual value of vehicles coming off of lease. When OEMs can confidently predict residual value, they can pass this confidence on to the market, benefitting both the OEM and their customers. To give one example, OEMs can offer more competitive rates on upfront leases to both consumer and fleet customers. Why? Because when they know the value will be high at the point of resale, they can price the initial lease lower with peace of mind – providing a direct benefit to customers.

With combustion-powered vehicles, automakers and their finance divisions have large, robust datasets to help make these predictions. They have been collecting the relevant data for decades, across millions of vehicles. With this information in hand, they can be sure to always price leases profitably, once resale proceeds are taken into account.

And just as OEMs depend on resale value with post-lease combustion vehicles, they are also depending on resale revenue with their newer fleets of post-lease electric vehicles. And establishing residual value in this setting requires the same basic steps as in the combustion-powered sector: get the right data, make the right predictions. Here’s Plug In America, summarizing the situation (emphasis ours):

“With thousands of new EVs coming off of leases, used EVs are more available than ever before, particularly in states where there has been a growing new EV market the past few years. Since battery electric vehicles (BEVs) have ten times fewer moving parts than gas cars, the only major concern in purchasing or leasing a used EV is the quality of the battery.”

Sounds easy, right? Perhaps even easier than with traditional vehicles: ten times fewer moving parts! The challenge is right there though: Most OEMs lack an effective way to assess battery quality, or battery health – leaving their resale strategy stuck in neutral.

The result of this battery blindness is that residual values for early EV lease programs are coming in several thousand dollars lower per-vehicle than predicted. At Voltaiq, we are hearing this again and again from OEMs. Discrepancies like this are more than enough to make or break profitability on a vehicle – damaging confidence in the resale market for EVs generally, and creating uncertainty around the business model for OEMs post-EV transition.

Auto OEMs Already Have the Data They Need

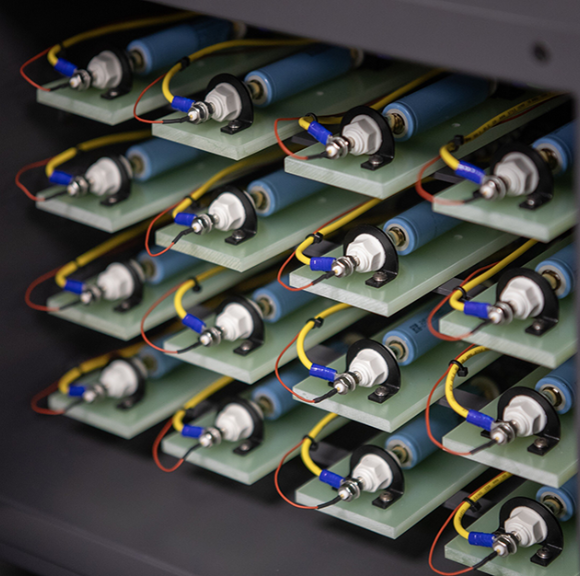

The battery pack is the single most valuable component in any electric vehicle. It is the piece of technology upon which the future performance, reliability, and lifespan of the vehicle most depends. In short: If an OEM cannot accurately assess the health of a battery, it can’t accurately assess the value of a vehicle.

This lack of insight is what we are currently seeing in the industry. Luckily, there is some good news:

- To quote a study from Getotab, “based on data from over 6,000 electric vehicles, spanning all the major makes and models, batteries are exhibiting high levels of sustained health. If the observed degradation rates are maintained, the vast majority of batteries will outlast the usable life of the vehicle.”

- Anecdotally, we hear the same. The industry is seeing that EV batteries only degrade modestly over three years (the typical length of a lease). This is comparable to, if not better than, the general depreciation one sees with combustion-powered cars. Thus, there is no underlying problem with the battery technology. The challenge is getting the information required to drive confidence and solidify resale strategies.

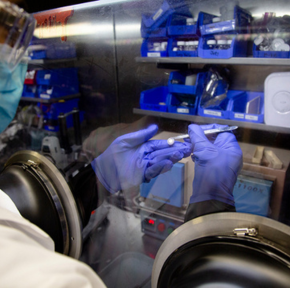

- That data that OEMs need already exists. Some manufacturers are already extracting this data from their EVs’ battery management systems, through a regular upload schedule. Other OEMs are rapidly developing the telematics capability to acquire this data from their fleets.

The problem is solvable, and the raw data is there – OEMs just need the right tools.

Introducing Enterprise Battery Intelligence

There is no reason that OEMs can’t get a clear picture of their vehicles’ battery health, and establish the residual value of EVs with the same accuracy and confidence as they do with combustion-powered vehicles.

At Voltaiq, we have developed a new class of battery analytics software broadly referred to as Enterprise Battery Intelligence (EBI) to help auto OEMs achieve this clarity. EBI leverages deep expertise in battery performance and aging, to produce real-time, data-driven health assessments of EV battery packs. This new software category gives auto OEMs the ability to combine all available data about a battery pack’s makeup – which suppliers the cells were sourced from, quality control measurements from manufacturing, and so on – with overall performance history, to produce a “Carfax-like” battery health report.

With this full-lifecycle analysis in hand, OEMs can add empirical proof to the positive anecdotes about your average three-year life of a battery. This capability will provide confidence to the market, and boost EV residual value and overall profitability.

The moment the market information gap closes, the challenges around residual value will vanish. Finance teams can make clear, confident – and exciting! – projections. All that is required is to establish an infrastructure and capability to accurately assess battery health.

Related Posts

The 2023 Battery Report

Battery Industry Trends: Key Insights and Trends from the Volta Foundation

Decoding the Heartbeat: Unlocking Battery Production Efficiency with Data

Subscribe to the Building Better Batteries Newsletter.

Written for battery engineers and leaders in the battery industry. Find resources, trends, and insights from some of the world's top battery experts.