Over the past few weeks we’ve had the opportunity to take the pulse of the battery ecosystem at a couple major conferences, InterBattery Korea, and the International Battery Seminar and Exhibit in Orlando, Florida. After connecting with hundreds of colleagues from around the globe, one thing is clear — the pressure is on. Long gone are the days of near-zero interest rates and free-flowing investor capital. Cash management, execution, and time to market are now paramount, even existential. For companies in the battery sector, this means hitting those delivery dates and performance milestones ahead of schedule, so you can secure the next round of funding while you still have runway. It means shipping product now, while making sure there are no nasty recalls coming a few months or a few years down the line. In other words, it’s time to put up or shut up.

Macro trends

Let’s take a look at some trends we’ve observed and try to draw some practical lessons that can help our partners across the battery industry to navigate these rough seas. The broader financial markets have shifted in the last several months to base valuation on near-term value rather than long-term potential. While layoffs and efficiency initiatives at the “Big Tech” companies dominate the headlines, there have been profound effects impacting a range of early-stage tech companies and battery companies in particular. The last few years saw a wave of companies spanning the mobility and energy storage sectors going public via SPAC to much fanfare, but at this point it’s safe to say that the music has stopped. Many of these companies are now trading well below the price they debuted at (Quantumscape, Gogoro), or even below cash on hand (Wejo, Otonomo). Battery SPACs in particular, many of them pre-revenue as they went public, achieved astronomical valuations based on aggressive projections around time to market and massive revenue growth. These companies have seen massive valuation resets as investors realize that these projections were overly optimistic, and that significant additional funding will be needed to reach full-scale production, let alone profitability. Likewise, for a range of high-profile private companies in the battery sector, investors are now reticent to inject substantial additional capital, advising portfolio companies to “run lean” or seek strategic investors to bridge both commercial and funding gaps. While the connection has not been made explicitly, it is likely that these dynamics have in part motivated leadership changes at companies like Solid Power, Enovix, Romeo Power, and more.

The drive to deliver

So what is a battery company to do in the midst of all this turmoil? The answer is pretty simple: It’s time to deliver.

The first step is to take a hard look at your cash situation, your prospects for raising additional capital, and deliverables you’ve committed to, and reset expectations with your customers, business partners, investors, and the broader financial markets. Here it’s vital to be realistic and make sure you’re transparent about any additional capital you need and confident in your projected roadmap and deliverable timelines. Management at publicly traded companies typically only gets one chance (maximum) to pull off this type of reset. Private companies in the battery sector in particular may have a little more leeway here, as climatetech investors tend to be more patient capital, with the understanding that portfolio company founders tend to be optimistic in their projections and build this into their model. However with the recent turmoil in the banking and financial sectors it’s likely that even these investors will hold their purse strings more tightly for the foreseeable future.

The next step is all about straightforward execution to hit delivery milestones and get your product to market, the sooner the better. For companies producing batteries that typically means delivering A, B, and C samples to your commercial partners. For EV companies it’s about shipping vehicles to customers. Earlier-stage companies will be looking to meet specific targets around performance and scale-up of your technology. Time is not your friend here, as you’re likely making minimal revenue at this stage while burning large amounts of cash and seeing your runway shrink. As such, it is vital to take stock of the things you can and can’t control as you make this push to market.

Time is not on your side

- Equipment: Equipment lead times stretched out significantly during the earlier stages of the global pandemic, and we’re still seeing equipment lead times of up to two years(!) for battery production equipment. These delays are especially problematic to battery production, and will continue to hinder plans for the many dozens of new gigafactories announced globally in the last year or so. The bottom line is that equipment lead times are out of your control.

- Materials: While less likely to be impacted by the global chip shortage, we are also seeing long lead times and delays in securing input materials, with leading suppliers prioritizing large supply contracts with the industry’s biggest players. Geopolitical instability over the last year has further led to volatility in the price and availability of a range of minerals and metals used heavily in the battery industry. Bottom line is this one is not in your control either.

- Qualification time: Whether you’re qualifying a new material supplier, piece of equipment, production process, or battery supplier for your product, qualification can take anywhere from a couple months to a few years. It does NOT pay to cut corners in qualification, lest you subject your end customers to a poor product experience or worse yet battery fires in their pockets and garages somewhere down the line. With that said, smart and efficient use of equipment and other qualification testing resources can accelerate timelines a bit, putting qualification timelines somewhat in your control.

- Iteration and learning: Finally, here’s a factor that is entirely within your control. Organizations with the tools, processes, and culture that promote fast iteration cycles and rapid learning can get to market faster and continuously improve their product over its lifecycle. Indeed renowned business thinker Arie de Geus is perhaps best known for saying “The ability to learn faster than your competitors may be the only sustainable competitive advantage.”

The key challenge for battery companies

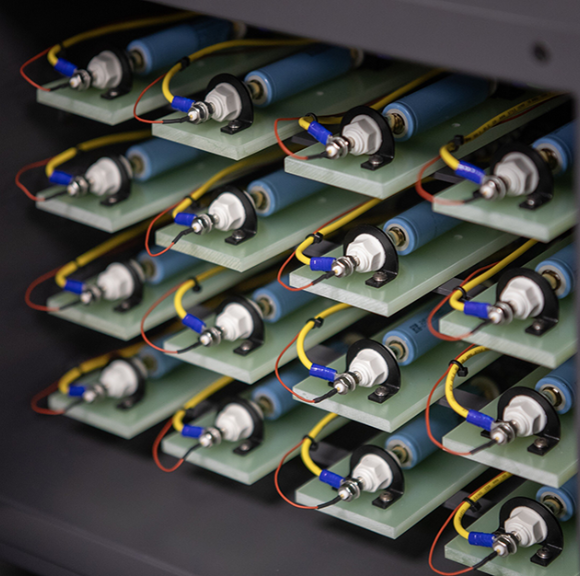

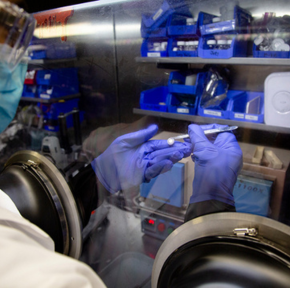

We’ve said it many times before — the key challenge for battery companies (or battery-powered companies, as we like to say), is that it takes a long time to determine if your batteries are any good. In the earliest stages of R&D, erratic, uneven results are the norm. With so many materials inputs and process steps to consider, manual processes for materials synthesis and cell fabrication, and limited testing resources, it can take years to show results that suggest you have a commercially viable new technology. Indeed a well-known rule of thumb is that it takes at least a decade to bring a new materials technology to market.

Scaling up battery production compounds these challenges, as larger volumes, faster throughput, and translating a lab-scale recipe to commercial equipment often means several months or even years to achieve the same performance previously observed in the lab. In addition, the formation and aging steps at the end of production typically span a couple weeks to a month, extending the time before you have a final quality evaluation of your cells. And though the battery has been around for a couple of centuries, large-scale lithium ion battery production is still a relatively nascent industry, meaning equipment isn’t standardized and even the most advanced producers rely largely on manual data collection and analysis when ramping up a new battery factory. The result is that iteration cycles can take months, and even the most sophisticated producers take 4-5 years to ramp up a new factory to profitability.

Companies integrating batteries into consumer electronics, mobility applications, and other systems are subject to these long cycle times too. Qualifying a new battery supplier or specific cell for your product involves extensive testing to map out the real-world application performance of the battery — supplier datasheets are not sufficient here. The long pole in the tent is usually cycle life testing, where you need to ensure the battery will perform adequately and safely throughout the applicable warranty period. For consumer electronics this testing typically takes several months, while qualifying a battery for a new electric vehicle can take as much as three years. And if you find an issue late in the game you have to identify a viable alternative and start that testing all over again.

How do we speed this all up?

To compete in today’s battery ecosystem, you have to learn faster than the competition, period. To do this, you need real-time data to give you the earliest indication things are going wrong, and the ability to quickly connect problems to upstream processes so you can address the issue and iterate. Data automation, rapid root-cause analysis, and quick time to insight are all table stakes at this point. As we’ve written about before, there are a few companies that have managed to develop this capability internally and have gone on to create literally trillions in market value on the back of a battery-powered product portfolio. What we see far more often, however, is companies thinking they can get by with legacy manual processes or by building up an internal software team to deliver these capabilities. Are you one of those companies? How is it going? If you’re like most companies, you’re struggling to put together the right team, or the team you’ve tasked with this is already stretched too thin, your internal analytics system is behind schedule, it won’t scale as you grow, and it costs way too much to maintain. Any of this sound familiar?

Of course there’s a better, faster way to uplevel your ability to learn, iterate, and gain competitive advantage. It’s through a new class of software solution known as Enterprise Battery Intelligence (EBI), which marshals data from across your organization and the full battery lifecycle to develop products faster, optimize performance, accelerate manufacturing scale-up, and minimize product risks. EBI changes the equation for companies trying to compete in today’s battery ecosystem. With EBI empowers you and your team to:

- Spot problems sooner

- Identify root cause faster

- Make better decisions, informed by data (not intuition)

- Iterate more quickly

- Identify viable alternatives when your first option doesn’t work out

Voltaiq pioneered the EBI sector, and for over a decade has been offering its turnkey, enterprise-class solution to companies spanning the full battery lifecycle: R&D, battery production, product integration, in-field use, and end of life. Indeed many of Voltaiq’s customers learned the hard way, spending years and untold millions on internal efforts before turning to the EBI leader to help accelerate their business. As engineers and builders we deeply understand the urge to “do it yourself”, but we have repeatedly observed the significant empirical benefits that companies derive when they adopt the leading commercial EBI solution.

In summary

From our vantage point working with leading companies across the sector, there has never been a more exciting time to work in the battery industry. The many thousands of dedicated people working to advance battery technology really are going to redefine what’s possible and change the world for the better. At the same time, the global economy has made it clear to all of us that the party is over. Markets and investors are a lot less forgiving than they were a year or two ago. In practical terms, that means it’s time to reset expectations (remembering you really only get one chance to do so), and deliver on or ahead of schedule. Smart companies intent on winning in this challenging market will adopt technologies like EBI that enable them to iterate faster and learn faster than the competition. Look for a follow-up post in the next couple of weeks where we’ll offer a few more specifics to different segments of the battery ecosystem. In the meantime, let’s get back to work driving toward that battery-powered future.

Related Posts

The 2023 Battery Report

Battery Industry Trends: Key Insights and Trends from the Volta Foundation

Decoding the Heartbeat: Unlocking Battery Production Efficiency with Data

Subscribe to the Building Better Batteries Newsletter.

Written for battery engineers and leaders in the battery industry. Find resources, trends, and insights from some of the world's top battery experts.